north dakota sales tax on vehicles

500 X 06 30 which is what you must pay in sales tax each month. Automobiles pickups and vans purchased to lease to others for 28 days or less are not subject to motor vehicle excise tax.

Minot State University Approved Logo Animales

The 5 sales tax and the 3 rental surcharge are separate charges with each applying to the rental charges and are in addition to motor vehicle excise tax paid on the vehicle purchase price.

. Registrations are valid from January 1 2020 to December 31 2022 fees are prorated according to the date of registration. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. To calculate registration fees online you must have the following information for your vehicle.

Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied. North Dakota has recent rate changes Thu Jul 01 2021. North Dakota sales tax.

The motor vehicle excise tax is in addition to motor vehicle registration fees for license plates. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees.

Or the following vehicle information. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Sales or Use Tax Motor Vehicle Excise Tax Titling License and Registration Vehicle Description ars Trucks Vans including new used or rebuilt No Yes - 4 Required Required Exception.

With local taxes the total sales tax rate is between 5000 and 8500. The state sales tax on a car purchase in North Dakota is 5. For vehicles that are being rented or leased see see taxation of leases and rentals.

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Select the North Dakota city from the list of popular cities below to see its current sales tax rate. Click here for a larger sales tax map or here for a sales tax table.

The car dealer will follow the sales tax collection laws of their own state. Some taxpayers may qualify for a refund on motor vehicle fuel tax. How are car trade-ins taxed in North Dakota.

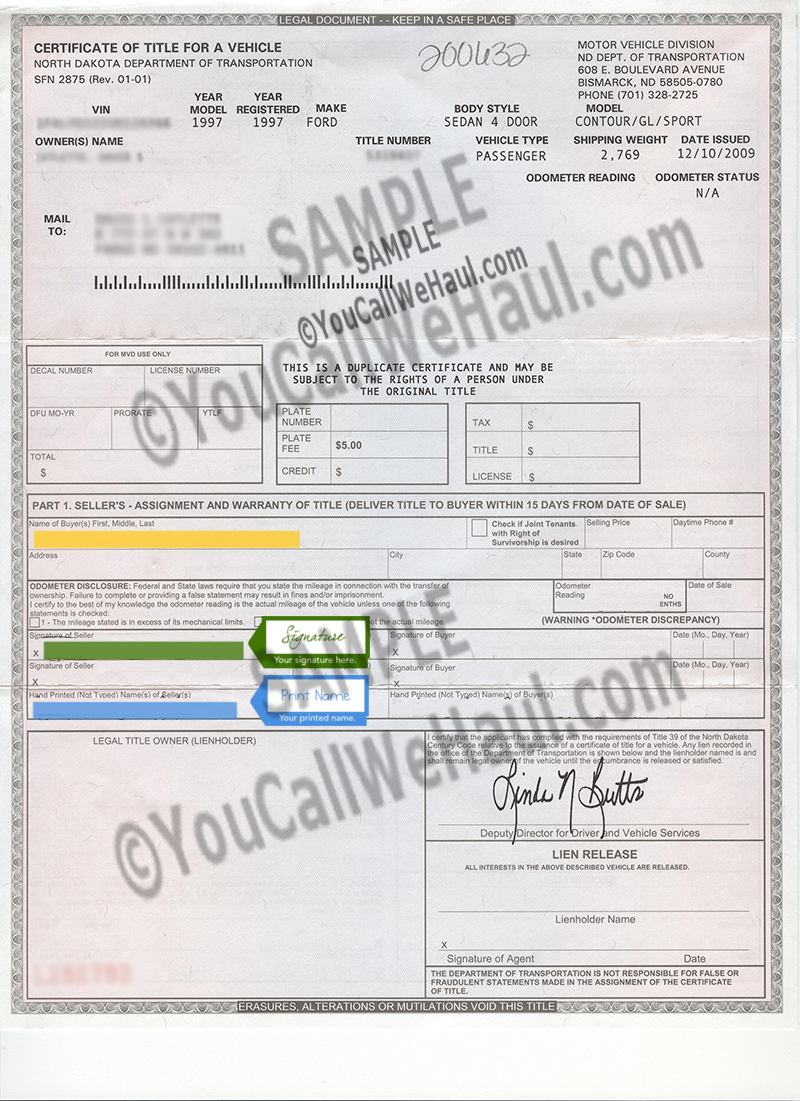

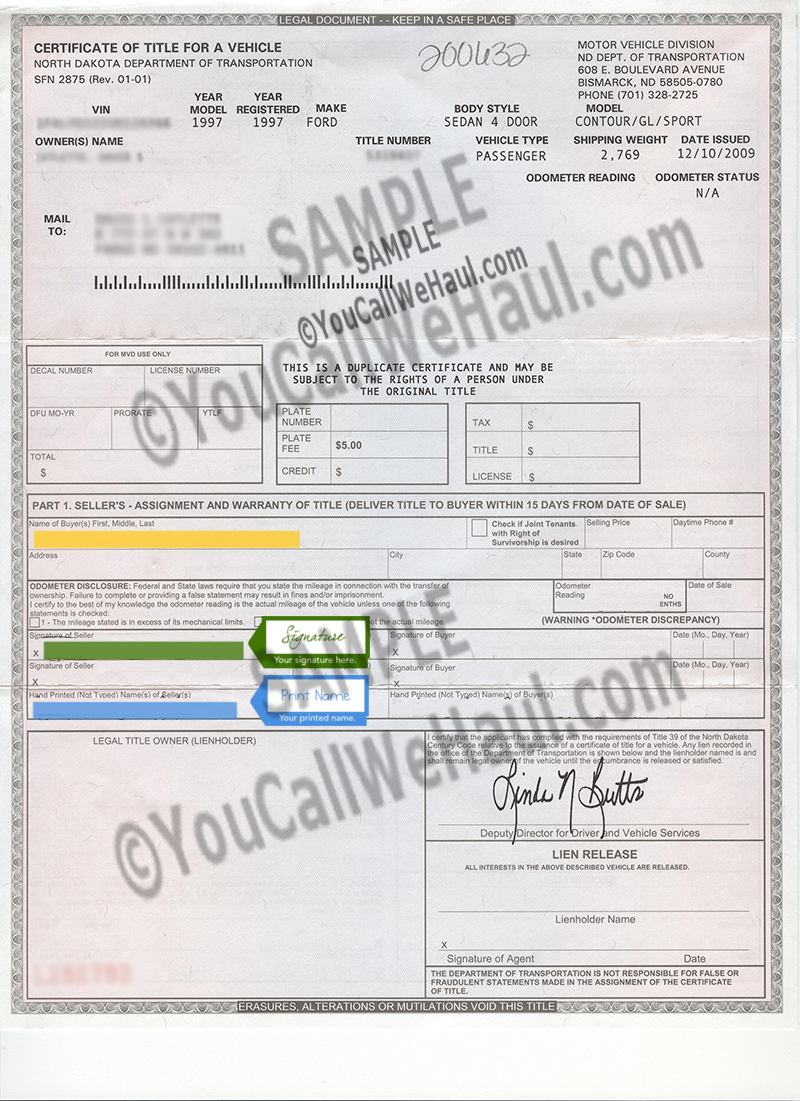

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Be sure the seller has signed dated and completed Part 1 including the odometer reading if the car is less than 10 years old. The 5 percent sales tax and the 3.

North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the vehicles age and weight. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency.

North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000. North Dakota Title Number. North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit.

Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. In North Dakota there are 3 types of motor fuel tax. The average local tax rate in North Dakota is 0959 which brings the total average rate to 5959.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Some examples of items that exempt from North Dakota sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture. However this does not include any potential local or county taxes.

North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit. Before the boat registration expires the North Dakota Game and Fish Department will mail a renewal notice. 5 tax on vehicle purchase price or fair market value of vehicle.

ND Boat Registration Renewals Replacements. How are trade-ins taxed. The state sales tax on a car purchase in North Dakota is 5.

Motor vehicle fuel includes gasoline and gasohol. Combined with the state sales tax the highest sales tax rate in North Dakota is 85 in the city. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

Gross receipts tax is applied to sales of. In the state of North Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. You can find these fees further down on the page.

5 of the sale price. Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 096.

The North Dakota 5 sales tax and 3 rental surcharge are imposed on rentals of motor vehicles for periods less than 30 days in this state. With local taxes the total sales tax rate is between 5000 and 8500. Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Groceries are exempt from the North Dakota sales tax Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. That way you dont have to deal with the fuss of trying to follow each states.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. Alcohol at 7 New farm machinery used exclusively for agriculture production at 3 New mobile homes at 3. You can find these fees further down on the page.

The motor vehicle excise tax must be paid to the North Dakota department of transportations motor vehicle division when application is made for registration plates or for a certificate of title for a motor vehicle. When you buy a car in North Dakota be sure to apply for a new registration within 5 days. Do South Dakota vehicle taxes apply to trade-ins and rebates.

The rate of penalty applied to delinquent sales tax returns was changed to. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6.

Car Sales Tax In North Dakota Getjerry Com

Nj Car Sales Tax Everything You Need To Know

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Quality Service With 30 Years Experience Lamonte S Auto Center In Custer Is Your One Stop Repair Shop Lamonte Is Ase C Wheel Alignment Truck Lights Custer

Pin By Denis On Veiculos In 2022 Emergency Vehicles Paper Model Car Police Cars

A Complete Guide On Car Sales Tax By State Shift

North Dakota Vehicle Registration Laws Com

Tennessee 2020 Passenger Issue This New Baseplate Was Introduced In January 2006 And Replaced All Previous Issues By The End Of The Year Placa De Carro Carros

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Infiniti Qx80 Lease Deals Incentives Special Offers Lease Deals Infiniti Usa Infiniti

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

What S The Car Sales Tax In Each State Find The Best Car Price

Rhode Island 2003 Non Passenger Plate Issue Embossed Navy Blue Serial On Reflective White Plate With Gray Wave Graphic Rhode Car Plates License Plate Plates

You Ve Never Seen Anything Like This North Dakota Oil Boomtown Groundwater Oil Rig Storage Tanks

North Dakota Vehicle Donation Title Questions Vehicles For Veterans