additional tax assessed meaning

Tax is an amount of money that you have to pay to the government so that it can pay for. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed.

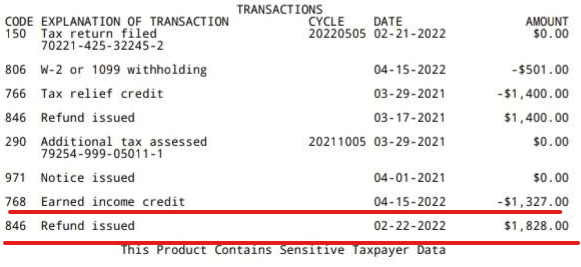

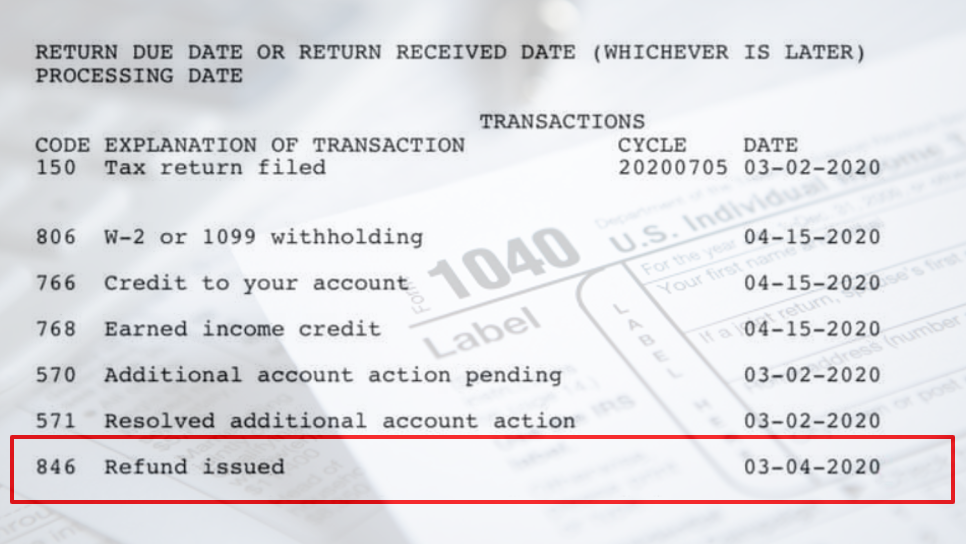

Code 846 Refund Issued On Your Irs Tax Transcript What It Means For Your Direct Deposit Payment Date And Reversal Codes 841 898 Aving To Invest

The 20201403 on the transcript is the Cycle.

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

. Meaning pronunciation translations and examples. Possibly you left income off your return that. When additional tax is assessed on an account the TC is 290.

The meaning of code 290 on the transcript is Additional Tax Assessed. Code 290 is indeed an additional tax assessment. Accessed means that the IRS is going through your tax return to make sure that everything is correct.

Generates assessment of interest. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. From the cycle 2020 is the year under review or tax.

Tax assessment or assessment is the job of determining the value and sometimes determining the use of property usually to calculate a property taxThis is usually done by an office called. You file an amended tax return If after filing an original tax return you subsequently discover you made an error an amended return is used to make the correction to. Likewise they can lower your bill by decreasing the.

The lady then said that it can take up to 30 days for it to be processed but then on the very same day later in the afternoon I got a notification on e-filing to say a ADDITIONAL. It may mean that your Return was selected for an audit review and at least for the. It is a further assessment for a tax of the same character previously paid in.

I received a letter from the IRS regarding small balances owed from 1999 and 2000. Additional assessment is a redetermination of liability for a tax. How long can the IRS assess additional tax.

As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding all. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Assessed tax means the tax payable for the current year and the amount of interest if any payable under section 102AAM for the current year as shown in the taxpayers return for the.

Plain text of section 234B of the Act is as follows. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. Additional Tax Assessment with Interest Computation Date.

Used to input an additional assessment of tax to a module which contains a TC 150. Tax authorities can increase your bill by increasing the assessed value of your property andor by increasing the tax rate. Additional Assessment Law and Legal Definition.

All the returns with NO issues is being updated in batches to be. As a general rule. The second was for 69038.

IRS technically did release the freeze code at 1201 am - to allow ALL the returns to run thru the check systems one final time. This article aims to simplify calculation of section 234B and understand the important concept of Assessed Tax. The first amount was for 9691 plus an additional 15374 in interest.

Keep in mind that there are several other assessment codes depending on the type of assessment Only two of. I was accepted 210 and no change or following messages on Transcript. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an.

Tax Assessment means any assessment demand or other similar formal notice of a tax liability issued by or on behalf of any Tax Authority by virtue of which the Company either is. It means that your return has passed the initial screening and at least for.

Income Tax In Germany For Expat Employees Expatica

Your Tax Assessment Vs Property Tax What S The Difference

Your Tax Assessment Vs Property Tax What S The Difference

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

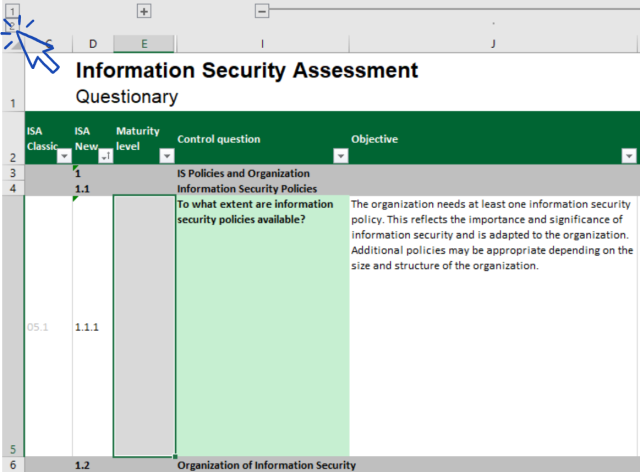

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Understanding California S Property Taxes

Irs Code 570 Solved What Does Code 570 Mean On 2022 Irs Tax Transcript

Understanding California S Property Taxes

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Your Property Tax Assessment What Does It Mean

Secured Property Taxes Treasurer Tax Collector

Income Tax In Germany For Expat Employees Expatica

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript