how much state tax is deducted from the paycheck

Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income. The first 45142 of taxable income plus 945 percent is taxable for this first 45142.

Yearly after all the taxes are paid for the take-home paycheck is 21597 in total.

. You can deduct the most common personal deductions to lower your taxable income. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. A 16 raise for the next 150000 up to 220000 plus.

Massachusetts is scheduled to begin collecting the paid family leave payroll tax on July 1 2019. 22 on the last 10526 231572. The average marginal tax rate is 259 while the average tax rate is.

Paycheck Deductions for 1000 Paycheck For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. The deduction for state and local taxes is no longer unlimited. 12 on the next 29774 357288.

FICA and State Insurance Taxes. In this 09 more tax is deducted for Medicare purposes. What are the taxes on 1000 paycheck.

Like Federal Income tax Employers are required to withhold State Income tax from the employees paycheck at the rates ranging from 535 to 985 distributed in 4 tax brackets depending on Income Level. Divide the total of your tax deductions by your total or gross pay. There is a 14 percent tax rate for earnings of 150000 up.

State Income Tax in Florida. According to the Ontario tax rates for 2021 the amount earned up to 45142 is taxed at a rate of 5. In amounts up to 150000 the tax rate is 11 percent.

If a resident of Georgia is earning more than 200000 then an additional tax is also applied on the paycheck called Medicare surtax. The total value of these deductions cannot exceed 6100 for single filers and 12200 for married filing jointly. 10 on the first 9700 970.

There is no state-level income tax so all you need to pay is federal income tax. This means the total percentage for tax deduction is 169. Minnesota State Income Tax.

Income Tax deduction under chapter VI-A for the FY2022-23 form 16 Part B for the FY2021-22 Income Tax Calculator in Excel for the FY2022-23. This cap applies to state income taxes local income taxes and property taxes combined. Youd pay a total of 685860 in.

If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. If youre single and you make 50000 after subtracting deductions exemptions etc you would pay.

How Your Paycheck Works. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return.

How Much FICA Tax Is Deducted In Ga. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. You will also need to consider the additional Medicare tax deduction due by higher-income employees which begins when the employee reaches a.

Therefore the total amount of taxes paid annually would be 4403. How Much Tax Is Deducted From My Paycheck Ontario 2021. At 15 percent your final balance will equal 90287 plus 11 percent Taking the next step an increase of 90000 to 150000 plus an addition of 14000.

Multiply the result by 100 to convert it to a percentage. The payroll tax will be 063 of the first 128400 of an employees annual earnings. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages.

How much is GA income tax. An amount over 45142 is taxed at 9142 up to 90287. Be careful not to deduct too much Social Security tax from high-income employees since Social Security is capped each year with the maximum amount being set by the Social Security Administration.

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

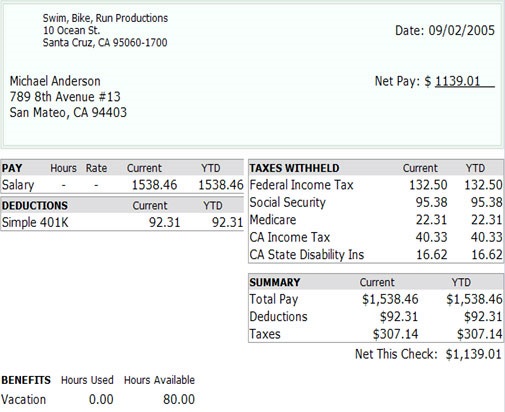

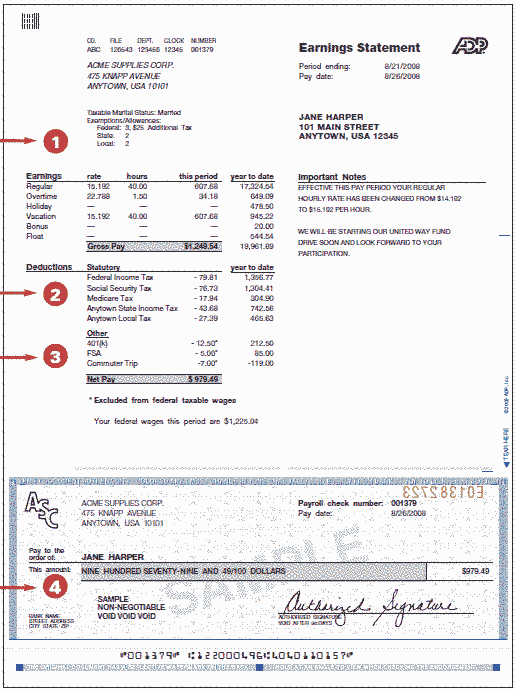

Understanding Your Paycheck Taxes Withholdings More Supermoney

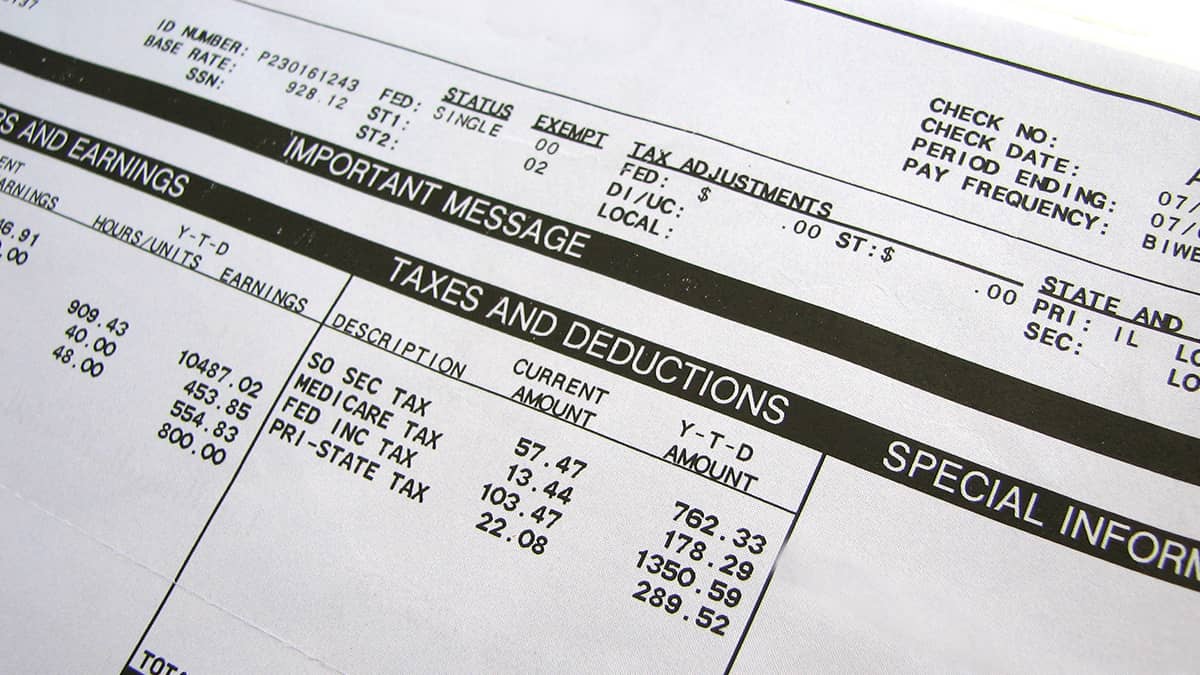

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Pay Statement Office Of Human Resources

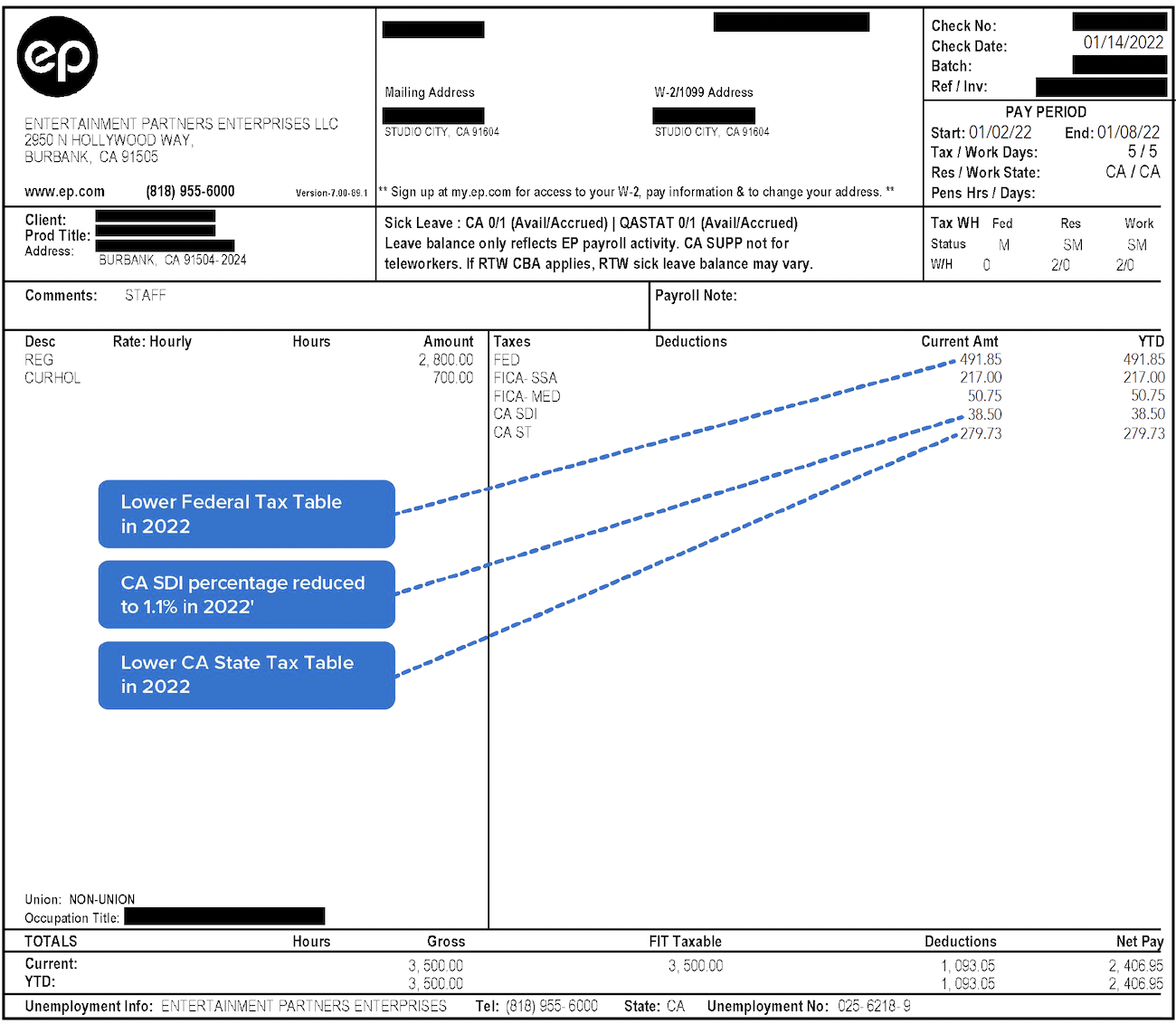

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Understanding Your Paycheck Credit Com

Mathematics For Work And Everyday Life

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

What Are Payroll Deductions Article

Different Types Of Payroll Deductions Gusto

Mathematics For Work And Everyday Life

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Paycheck Calculator Online For Per Pay Period Create W 4

Decoding Your Paystub In 2022 Entertainment Partners

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life